It’s a hard but true fact – no more do businesses survive without leverages. In a quest for success and expansion, they need to resort to debt, because equity alone fails to ensure survival. Be it funding a new project, fulfilling working capital requirement or expanding business operations, an organization needs funding for various corporate activities.

Talking of India, the credit market scenario in here is not so matured in comparison to other developed countries; hence there exists an excessive dependency level on conventional banking structure. Nevertheless, raising finance from issuance of bonds by companies is also not so rare – majority of companies in need of capital raise money from bonds and shares and this practice is widely prevalent throughout the nation.

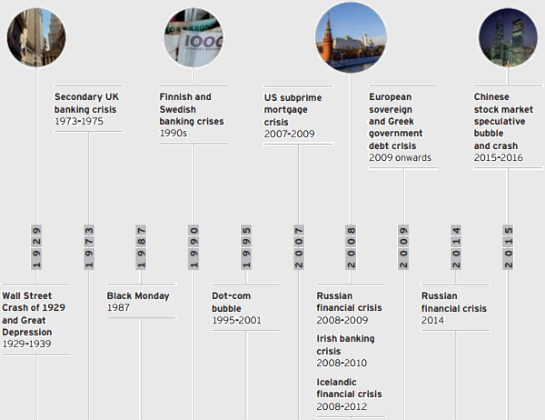

Today, credit default is one of the most common financial risks that companies are vulnerable to. Global markets have bore the brunt of it extensively, and are still at risk from a dreadful economic meltdown.

India too has witnessed some blaring cases of credit default and freezing of assets, namely Kingfisher airlines (outstanding debt of more than Rs.7,500 Crore) and Sahara (outstanding debt of Rs 11,136 Crore), much of them remains still unresolved. As a result, credit risk analysis is of prime importance – it is defined as the assessment of a company’s ability to repay its financial obligations.

When to apply credit risk analysis?

It is mostly applied in two cases:

- When a company issues bonds in the market

- When a company asks for a loan from any bank of financial institute for corporate gains

Remember, when a loan is taken from a bank, the entire credit team is asked to carry out a productive credit analysis using state-of-the-art financial models. And this analysis is performed in the following way:

- Assess whether the borrowing company will be at default or not

- Assign a particular risk rating to promote decision making

- In case of default, what amount of loss will be the lender bear

Going by the chart mentioned above, banks and other credit rating agencies need to take a closer look on 5Ps i.e. People, Purpose, Payment, Protection and Prospects to decide the credit worthiness of the borrower.

Techniques to Follow for Better Credit Risk Analytics

Here are a set of advanced credit risk analytics techniques that credit rating agencies opt for smoother analytical procedures:

Financial Statement Analysis

Additional financial information helps! Banks should look for updated financial statements of the company in question for better analysis.

Ratio and Trend Analysis

One of the most significant things to consider is the debt-service coverage ratio – it should be 1.2 or more indicating the company can pay off its debt with an extra coverage for other contingencies.

Collateral Analysis

Collateral is a defining instrument to curb credit risk. In case, if the cash flow fails to repay any loan, the collateral can be sold to repay outstanding amounts.

Credit Scoring System

It is the best tool to determine the credit worthiness of a potential borrower. In this accounting-oriented credit scoring system, the analyst looks deep into key accounting ratios of borrowers to compare them with the industry standards.

Drawing out projections

Making projections is the toughest nut to crack for any credit risk analyst. A constructive financial model, structured on historical data and future year prediction serves as the right tool to fuel credit analysis – so focus on such model creation for better decision-making anytime.

Credit risk analysis course online would be the best way to gain solid understanding of financial statements and master critical credit risk modeling skills. DexLab Analytics is a leading credit risk modeling training institute in Delhi, why not check out their courses!

Interested in a career in Data Analyst?

To learn more about Machine Learning Using Python and Spark – click here.

To learn more about Data Analyst with Advanced excel course – click here.

To learn more about Data Analyst with SAS Course – click here.

To learn more about Data Analyst with R Course – click here.

To learn more about Big Data Course – click here.

Comments are closed here.