The noteworthy triumphs over us, humans, in Poker, GO, speech recognition, language translation, image identification and virtual assistance have enhanced the market of AI, machine learning and neural networks, triggering exponential razzmatazz of Apple (#1 as of February 17), Google (#2), Microsoft (#3), Amazon (#5), and Facebook (#6). While these digital natives command the daily headlines, a tug of war has been boiling of late between two ace developers – Equifax and SAS – the former is busy in developing deep learning tools to refine credit scoring, and the latter is adding new deep learning functionality to its bouquet of data mining tools and providing a deep learning API.

Both companies know what they are doing and are certain about their future goals. Equifax was founded in 1899 as a credit reporting agency to collect and analyse data of more than 820 million customers and around 91 million businesses across the globe. On the other hand, SAS, established in 1976 excels in developing and selling data analytics and data management software.

The AI news that is making flashy headlines today has a rich lineage. In the past few decades, machine learning successfully solved problems, such as spam filtering, handwriting recognition, machine translation, fraud detection, and product recommendations in a snap of a finger. Using large chunks of data helped predictive models be more robust and churn out more accurate outcomes. Oliver Schabenberger, Executive Vice President and Chief Technology Officer at SAS said, “What sometimes gets overlooked is that it’s really the data that drives machine learning.”

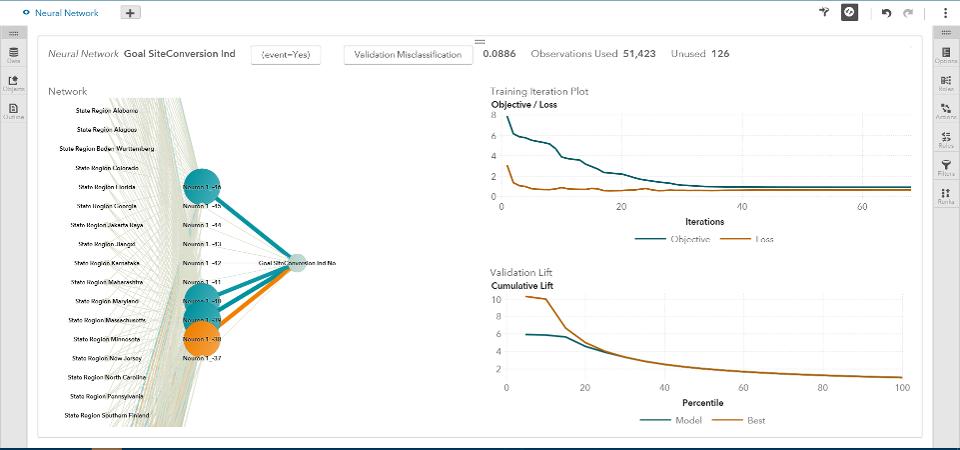

Deep Learning, a new type of machine learning, boosted by Big Data takes the entire analytics game a notch higher by applying it to a multi-layer “artificial neural networks.” AI strives “to make a machine that thinks like a human. Deep neural networks try to solve pretty narrow tasks,” said Schabenberger.

On the other side, “We noticed a couple of years ago,” said Peter Maynard, Senior Vice President of Global Analytics at Equifax, “that we were not getting enough statistical lift from our traditional credit scoring methodology.” That was when, “My team decided to challenge that and find a way to make neural nets interpretable,” says Maynard. He clarified: “We developed a mathematical proof that shows that we could generate a neural net solution that can be completely interpretable for regulatory purposes. Each of the inputs can map into the hidden layer of the neural network and we imposed a set of criteria that enable us to interpret the attributes coming into the final model. We stripped apart the black box so we can have an interpretable outcome. That was revolutionary, no one has ever done that before,” he further added.

From Maynard’s report, we witnessed that the neural net has improved the predictive ability to almost more than 15%. Complex analysis and bigger data sets could now be analysed in a flick of an eye, and that is really awesome! The immediate benefit was – improved and faster model development, as models are built and tested, automatically. ”You have a human reviewing it to make sure it’s executing as intended, but the whole thing is done automatically. It’s similar to search optimization or product recommendations where the model gets tweaked every time you click. In credit scoring, when you have a neural network with superior predictability and interpretability, there is no reason to have a person in the middle of that process.”- Maynard was found saying.

Moreover, the factors or the attributes that affect a credit score were all data-driven. The deep learning process developed these factors. The algorithms decided what would be the most predictive, in relation to the behaviour the analysts were trying to model. However, the most significant boon of implementing modern machine learning tools was greater access to credit. Maynard said, “The use case we showed regulators, was in the telecom industry where people had to put down a down payment to get a cell phone—with this model they don’t need to do that anymore.”

For more such news and information on, follow us at DexLab Analytics. It is a prime credit risk modeling training institute in Delhi, excelling on plethora of high-end interactive data science online training courses.

Interested in a career in Data Analyst?

To learn more about Machine Learning Using Python and Spark – click here.

To learn more about Data Analyst with Advanced excel course – click here.

To learn more about Data Analyst with SAS Course – click here.

To learn more about Data Analyst with R Course – click here.

To learn more about Big Data Course – click here.

Comments are closed here.